Writing a letter to the IRS can feel daunting, whether you are claiming a dependent or disputing a charge. A well-structured letter is crucial, especially when making an independent claim for a dependent or requesting to waive a penalty.

These sample letters provide a clear and formal template for communicating with the IRS. Using a proper format helps ensure your request is understood and processed efficiently, whether you’re addressing a dependent claim or seeking penalty relief.

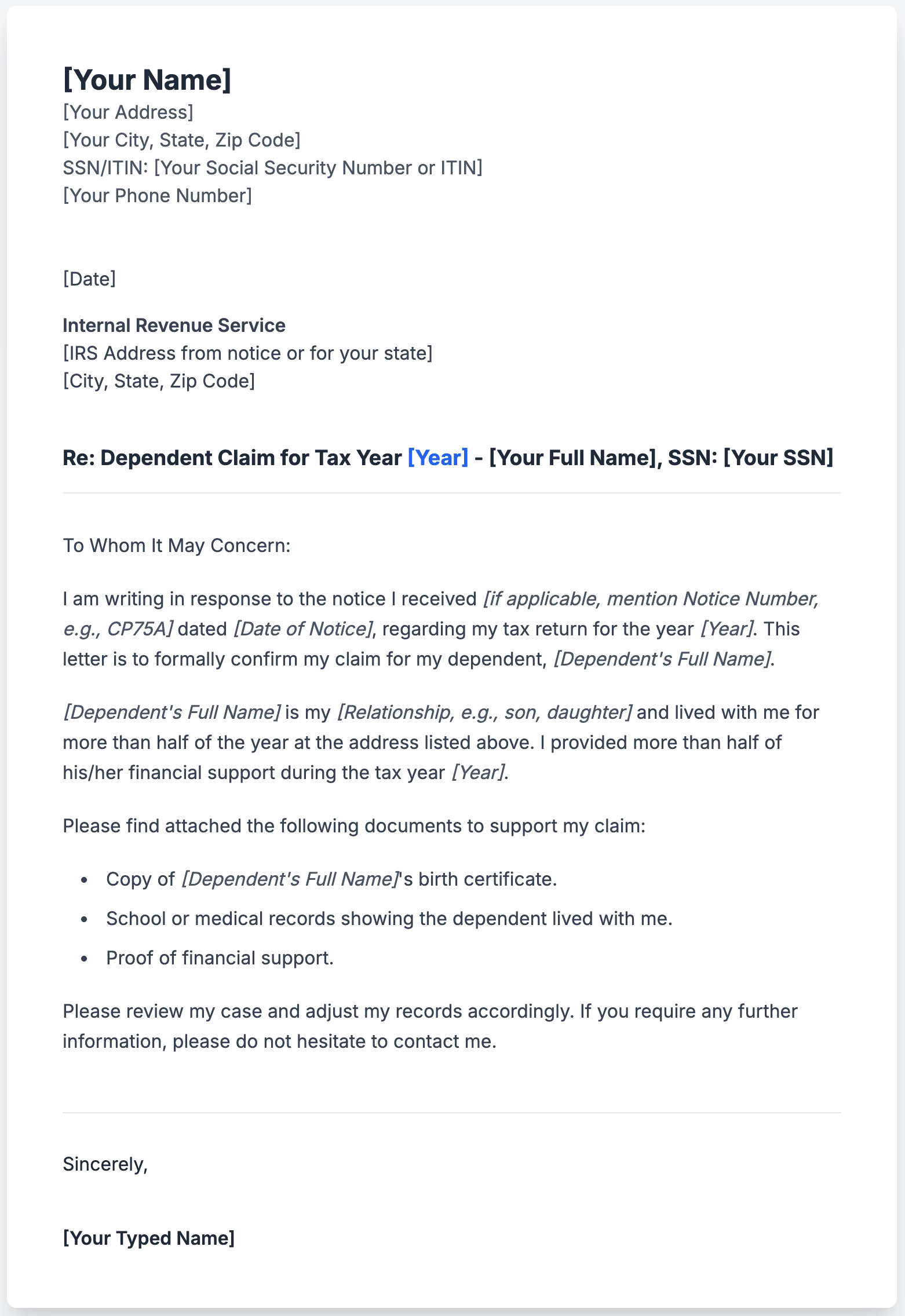

IRS Claiming Dependent Letter Sample

[Your Name]

[Your Address]

[Your City, State, Zip Code]

[Your Social Security Number or ITIN]

[Your Phone Number]

[Date]

Internal Revenue Service

[IRS Address from the notice you received, or the appropriate address for your state]

[City, State, Zip Code]

Re: Dependent Claim for Tax Year [Year] – [Your Full Name], SSN: [Your SSN]

To Whom It May Concern:

I am writing in response to the notice I received [if applicable, mention Notice Number, e.g., CP75A] dated [Date of Notice], regarding my tax return for the year [Year]. This letter is to formally confirm my claim for my dependent, [Dependent’s Full Name].

[Dependent’s Full Name] is my [Relationship, e.g., son, daughter] and lived with me for more than half of the year at the address listed above. I provided more than half of his/her financial support during the tax year [Year].

Please find attached the following documents to support my claim:

- Copy of [Dependent’s Full Name]’s birth certificate.

- School or medical records showing the dependent lived with me.

- Proof of financial support.

Please review my case and adjust my records accordingly. If you require any further information, please do not hesitate to contact me.

Sincerely,

[Your Signature]

[Your Typed Name]

Independent Claim Letter Sample to IRS

Subject: Independent Claim for [Dependent’s Name], SSN: [Dependent’s SSN] for Tax Year [Year]

To Whom It May Concern:

I am writing to formally assert my right to claim [Dependent’s Full Name] as a qualifying child for the tax year [Year]. I understand that another taxpayer may have also claimed this dependent, and I wish to provide information to prove my claim is valid under IRS rules.

[Dependent’s Name] is my [Relationship] and resided with me for [Number] months during [Year]. I was the primary provider of financial support, covering costs for housing, food, and medical care. Under the IRS tie-breaker rules, I believe I have the legal right to claim this dependent. I have enclosed documentation to support this.

Sample Letter to IRS to Waive Penalty

Subject: Request for Penalty Abatement for Tax Year [Year] – Notice [Notice Number]

To Whom It May Concern:

I am writing to respectfully request a waiver of the penalty assessed on my account for the tax year [Year], as detailed in Notice [Notice Number], dated [Date of Notice]. The penalty amount is $[Amount].

I am requesting this abatement due to [Choose one: “first-time penalty abatement criteria” or explain the “reasonable cause”]. For “reasonable cause,” you can explain the situation, for example: “I was unable to file on time due to a serious medical emergency that required hospitalization from [Start Date] to [End Date].” I have attached documentation to support my claim.

I have taken steps to ensure this does not happen again. Thank you for your consideration of this request.

Related;