When a loved one passes away, managing their financial affairs, including notifying credit bureaus, is a critical step to prevent identity theft. Informing these agencies and creditors promptly helps secure the deceased’s accounts and credit file.

Using a clear and concise letter template ensures you provide all the necessary information. This formal notification is an official way to report a death to a credit bureau or inform a creditor about a deceased debtor, initiating the process of closing accounts and settling any outstanding matters.

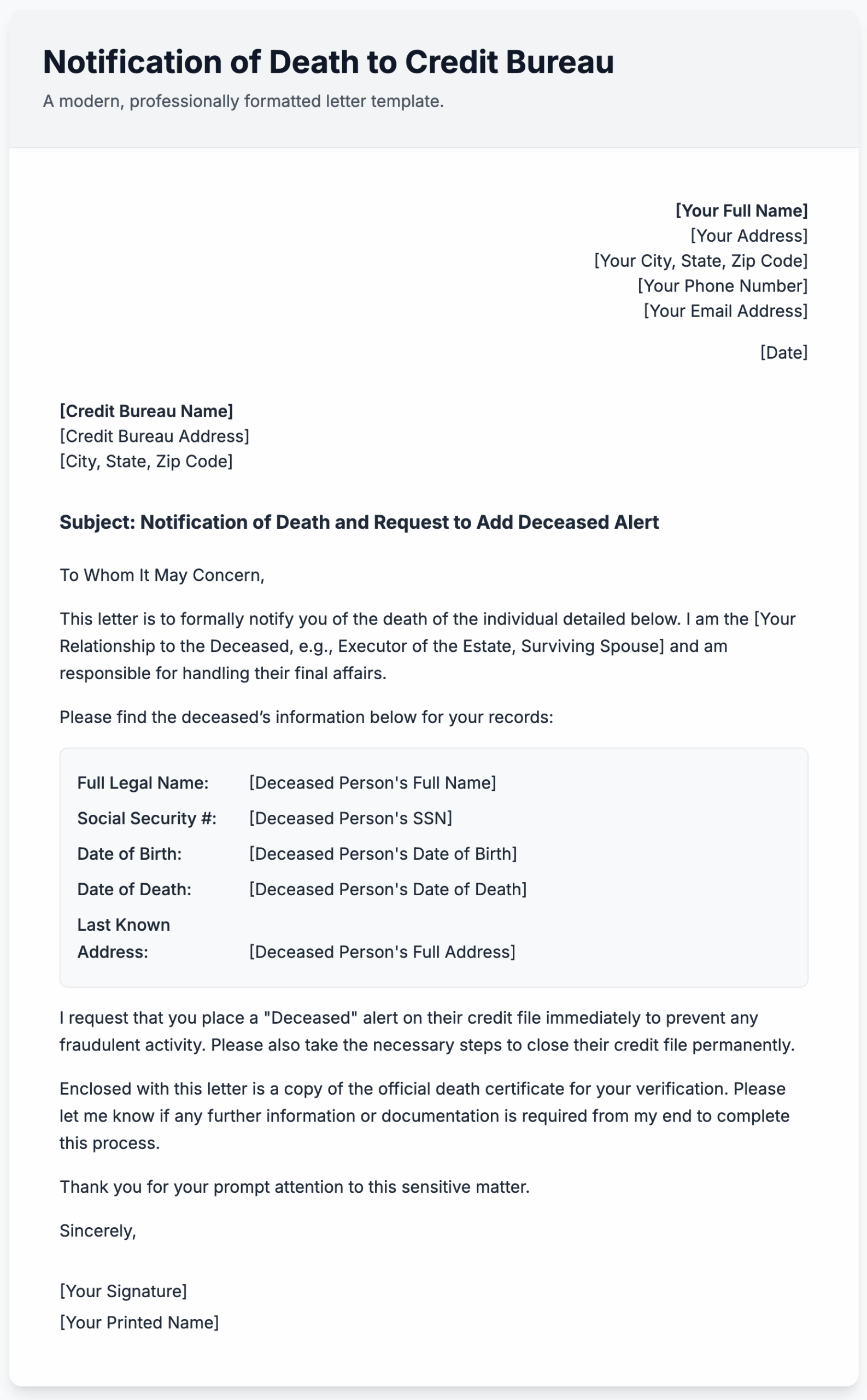

Sample Letter to Credit Bureau to Report Death

[Your Full Name]

[Your Address]

[Your City, State, Zip Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, Zip Code]

Subject: Notification of Death and Request to Add Deceased Alert

To Whom It May Concern,

This letter is to formally notify you of the death of the individual detailed below. I am the [Your Relationship to the Deceased, e.g., Executor of the Estate, Surviving Spouse] and am responsible for handling their final affairs.

Please find the deceased’s information below:

- Full Legal Name: [Deceased Person’s Full Name]

- Social Security Number: [Deceased Person’s SSN]

- Date of Birth: [Deceased Person’s Date of Birth]

- Date of Death: [Deceased Person’s Date of Death]

- Last Known Address: [Deceased Person’s Full Address]

I request that you place a “Deceased” alert on their credit file immediately to prevent any fraudulent activity. Please also close their credit file permanently.

Enclosed is a copy of the official death certificate for your records. Please let me know if any further information or documentation is required from my end.

Thank you for your prompt attention to this sensitive matter.

Sincerely,

[Your Signature]

[Your Printed Name]

Letter Template Notifying Credit Bureaus of Death

Subject: Formal Notification of Death – [Deceased’s Full Name]

This letter serves as a formal notification of the death of [Deceased’s Full Name], Social Security Number [Deceased’s SSN]. Their date of birth was [Deceased’s Date of Birth], and they passed away on [Date of Death].

I am the executor of the estate and request that you mark their credit file as “Deceased” to prevent unauthorized use of their identity. I have included a copy of the death certificate. Please confirm in writing once this action has been completed.

Sample Letter to a Creditor Regarding a Deceased Debtor

Subject: Account of [Deceased’s Full Name], Account Number: [Account Number]

This is to inform you that the above-named account holder, [Deceased’s Full Name], passed away on [Date of Death]. I am managing their estate.

Please freeze the account to prevent any further charges. Could you please provide a final statement of any outstanding balance due on this account? Kindly direct all future correspondence regarding this account to me at the address listed above.

Sample Death Notice to Creditors

Subject: Notice of Death for [Deceased’s Full Name]

Please be advised that [Deceased’s Full Name], a resident of [City, State], passed away on [Date of Death].

This notice is being sent to you as you may be a potential creditor. If there is an outstanding account in the deceased’s name, please provide detailed information, including the account number and any outstanding balance, to me at [Your Mailing Address] within 30 days.

Essential Tips for Writing a Death Notification Letter

Writing these letters requires care and attention to detail to ensure the process is handled smoothly. Following a few key tips can help you manage the task effectively and protect the deceased’s estate from potential complications.

Gather Necessary Documents

To streamline the process, assemble all required paperwork beforehand. A certified copy of the death certificate is paramount, as this is standard proof for most organizations. Additionally, have the deceased’s personal details on hand, including their full legal name, SSN, birth and death dates, and final address. Being prepared with this data will prevent delays.

Be Clear and Concise

When drafting your letter, clarity is key. Get straight to the point in your opening sentence. It is best to maintain a professional, factual tone and refrain from including personal sentiments. The objective is to formally notify the recipient, which helps ensure your request is processed without confusion. A descriptive subject line is also highly effective.

Use Certified Mail

Sending your notification via this method creates a verifiable record. This service gives you legal confirmation of delivery, showing when and by whom the letter was received. This paper trail is incredibly important for your records, especially if you need to prove you sent the notification in case of future discrepancies or fraudulent activity.

Include Your Contact Information

It’s essential to include your complete contact details. The institution will need a designated person to communicate with regarding any questions or next steps for the deceased’s accounts. By providing your name, address, and phone number, you establish yourself as the official point of contact, which helps prevent miscommunication and ensures a smoother resolution.

Related: