Medical collections can harm your credit score even after you’ve paid or resolved the issue. Writing a clear, professional dispute letter can help you correct errors, remove inaccurate medical collections, or request goodwill adjustments.

In this guide, you’ll find practical sample letters you can use to challenge medical bills listed on your credit report. Each letter is written to help you communicate effectively with credit bureaus, debt collectors, or healthcare providers, ensuring your financial record accurately reflects your payment history.

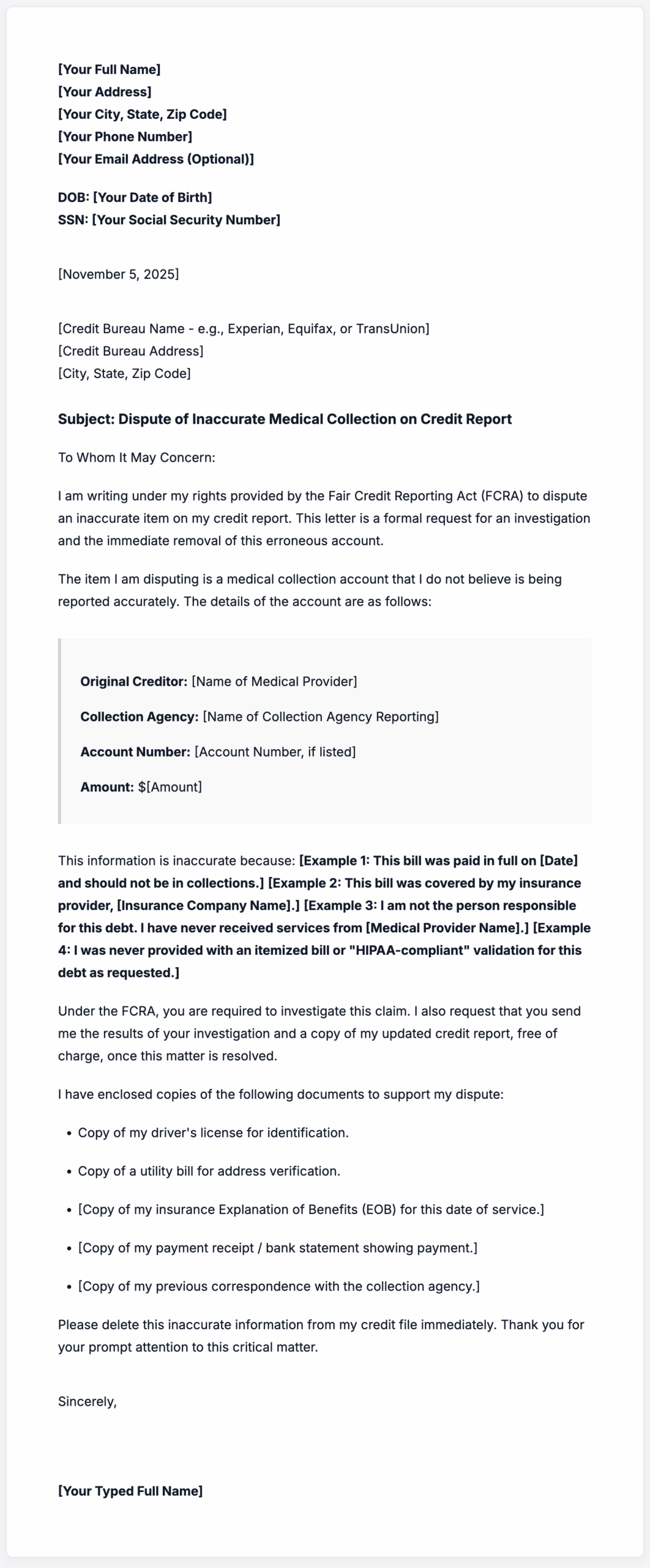

Sample Letter To Dispute Medical Bills On Credit Report

Subject: Dispute of Inaccurate Medical Bill on Credit Report

Dear [Credit Bureau Name],

I am writing to formally dispute a medical bill listed on my credit report that I believe is inaccurate. The entry from [Name of Medical Provider or Collection Agency], dated [Date], shows an unpaid balance of [Amount], which I do not owe or has already been resolved.

According to the Fair Credit Reporting Act, I am requesting a thorough investigation and verification of this account. Please provide written documentation proving the validity of the debt, including billing records and authorization of the collection. If such verification cannot be provided, I ask that this item be promptly removed from my credit report.

Enclosed are copies of supporting documents, such as payment confirmations and correspondence with the medical provider. Please notify me of your findings within the 30-day investigation period.

Thank you for your attention to this matter. I look forward to your prompt response.

Sincerely,

[Your Full Name]

[Your Address]

[City, State, ZIP]

[Date of Birth]

[Last Four Digits of SSN]

Remove Medical Collections Without Paying Sample Letter

This is a formal request to remove a medical collection account from my credit report, as it was reported in error and does not reflect my current payment status. The collection, listed under [Collection Agency or Provider Name], has either been resolved directly with the provider or was never properly validated.

Under the Fair Credit Reporting Act, I request the deletion of this item since it does not meet reporting accuracy requirements. Please provide confirmation once the entry has been removed.

Letter To Remove Medical Collection

I am requesting the removal of a medical collection account from my credit file due to its inaccurate reporting. This account, associated with [Provider or Agency Name], has been verified as paid in full, yet it continues to appear as outstanding.

Please update your records to reflect the correct payment status or delete the entry altogether. I have included payment receipts and account statements for your reference.

Medical Bills Collections Credit Report Letter Template

To Whom It May Concern,

I recently noticed a medical bill collection listed under [Collection Agency Name] on my credit report. I believe this account was either billed incorrectly or should have been handled directly through my insurance provider. I request that your office verify this account’s validity with complete billing documentation.

If verification cannot be produced, I request immediate removal of this collection from my credit file with all reporting bureaus. I appreciate your cooperation in resolving this matter promptly.

Tips For Writing A Medical Bill Dispute Or Collection Removal Letter

Use Clear And Specific Details

Include the account name, number, and date of the medical service or billing entry. Specific details make it easier for the bureau or agency to locate and review your case accurately.

Provide Supporting Documents

Attach copies of receipts, explanation of benefits (EOBs), or insurance claim statements. Documentation strengthens your claim and increases the chances of successful correction or removal.

Reference The Fair Credit Reporting Act

Mention your rights under the FCRA to dispute inaccurate or unverifiable information. This emphasizes that your request is valid and supported by federal consumer protection laws.

Maintain A Professional Tone

Even if you are frustrated by billing or reporting errors, keep your language polite and factual. A professional tone improves the likelihood of timely and positive action.

Follow Up And Keep Records

Send your letter via certified mail and retain copies of all correspondence. If no response is received within 30 days, follow up with both the credit bureau and the collection agency to ensure compliance.

Related: