If you’ve been charged a penalty by the IRS, it’s possible to request forgiveness or abatement under certain conditions. Writing a penalty waiver request letter can help you explain your situation clearly and professionally. Whether you’re seeking first-time penalty abatement or asking for leniency due to reasonable cause, the right tone and structure can make a big difference.

Below are four sample letters and templates you can use when writing to the IRS to waive or reduce penalties. Each example is crafted for different circumstances so you can choose the one that best fits your case.

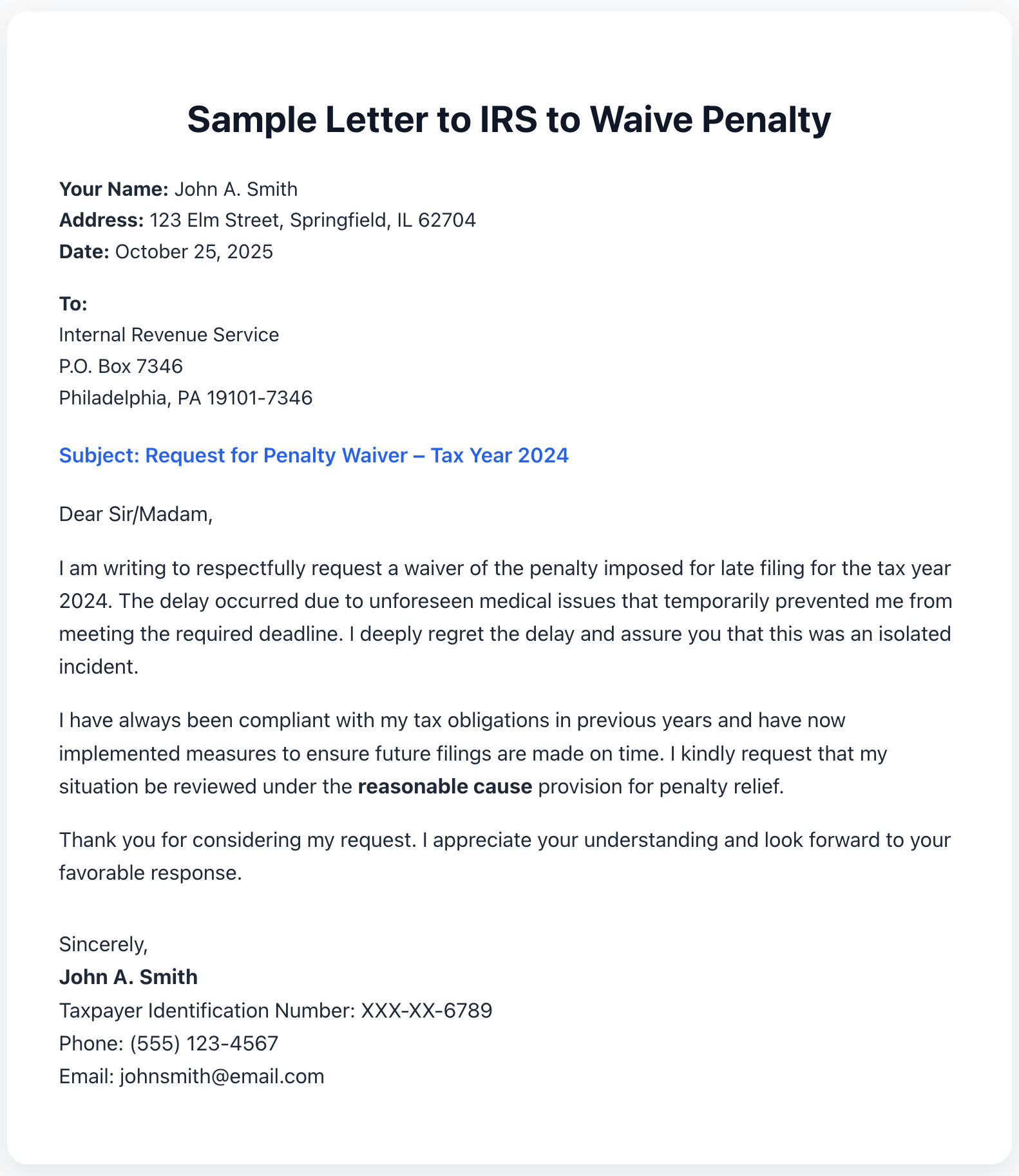

Sample Letter to IRS to Waive Penalty

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

Internal Revenue Service

[Address of IRS Office]

Subject: Request for Penalty Waiver – [Tax Year/Type]

Dear Sir/Madam,

I am writing to respectfully request a waiver of the penalty imposed for [mention reason, e.g., late payment or late filing] for the tax year [mention year]. I understand my responsibility to comply with all IRS requirements; however, the delay was caused by [briefly explain reason, such as illness, natural disaster, or financial hardship].

I have always made timely payments in the past and have taken steps to ensure such an issue does not happen again. Please consider my request under the reasonable cause provision for penalty relief.

Thank you for your time and understanding. I look forward to your favorable response.

Sincerely,

[Your Full Name]

[Your Contact Number]

[Your Taxpayer Identification Number]

IRS Penalty Forgiveness Letter Sample

I am writing to request penalty forgiveness related to my [mention tax type or year] account. Due to [state specific reason, such as unforeseen medical emergency or system error], I was unable to meet the deadline.

This incident was unintentional, and I have since corrected the issue by submitting all required documents and payments. I kindly ask that the IRS consider removing the penalty as a gesture of understanding. I have been compliant in previous years and intend to continue maintaining full compliance moving forward.

Penalty Waiver Request Letter Template

This penalty waiver request template can be customized for your situation:

Subject: Request for Penalty Waiver

To Whom It May Concern,

I respectfully request the removal of penalties assessed for [specific issue, e.g., failure to deposit, failure to file]. The delay occurred due to [describe reasonable cause such as technical difficulties, banking delays, or miscommunication].

Please consider granting a penalty abatement based on my history of timely compliance and good faith efforts. Attached are supporting documents to validate my claim.

Thank you for considering my request.

First Time Penalty Abatement Letter Sample to IRS

As a taxpayer with a consistent history of timely filing and payment, I am requesting First Time Penalty Abatement (FTA) for the [tax year/type]. This is the first time I have encountered such an issue, and I understand the importance of meeting IRS deadlines.

According to the IRS FTA policy, eligible taxpayers may receive relief if they have a clean compliance history. I meet this requirement and would be grateful for your consideration to remove the assessed penalty.

Please let me know if any additional documentation is required to process this request.

Tips for Writing an Effective IRS Penalty Waiver Letter

Be Clear and Direct

Start by clearly stating the purpose of your letter—requesting a waiver or abatement of IRS penalties. Avoid unnecessary details and keep your explanation focused.

Explain the Reason Honestly

The IRS grants penalty relief mainly for reasonable causes like illness, natural disasters, or unavoidable delays. Explain your circumstances truthfully and include brief, factual descriptions.

Support Your Claim with Documentation

Attach any relevant proof such as hospital records, financial hardship evidence, or correspondence delays. This strengthens your case and shows genuine effort to comply.

Maintain a Respectful and Professional Tone

Even if you feel frustrated, remain polite throughout the letter. A respectful tone improves your chances of approval and reflects well on your intent.

End with a Positive Note

Close your letter by reaffirming your commitment to future compliance and appreciation for the IRS’s consideration. This reinforces sincerity and accountability.

Related: