Removing a judgment from your credit report is essential for maintaining a healthy credit score and improving your financial standing. Whether the judgment was mistakenly reported or has been resolved, sending a well-crafted letter can help you address this issue effectively.

In the following sample letters, you will find useful templates to request the removal of judgments from your credit report, including approaches to remove old judgments, ensuring your credit history reflects accurate information.

Sample Letter to Remove Judgment from Credit Report

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

Credit Reporting Agency

[Agency Address]

[City, State, ZIP Code]

Subject: Request for Removal of Judgment from Credit Report

Dear Sir/Madam,

I am writing to formally request the removal of a judgment that appears on my credit report. The judgment referenced under case number [Case Number] was entered on [Date], and it has either been satisfied, resolved, or reported in error.

I have attached documents supporting this request, including proof of payment and a court order confirming the judgment’s satisfaction. I kindly ask that you verify this information and update my credit report accordingly.

Please notify me once this correction has been made, or if further information is required.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Contact Information]

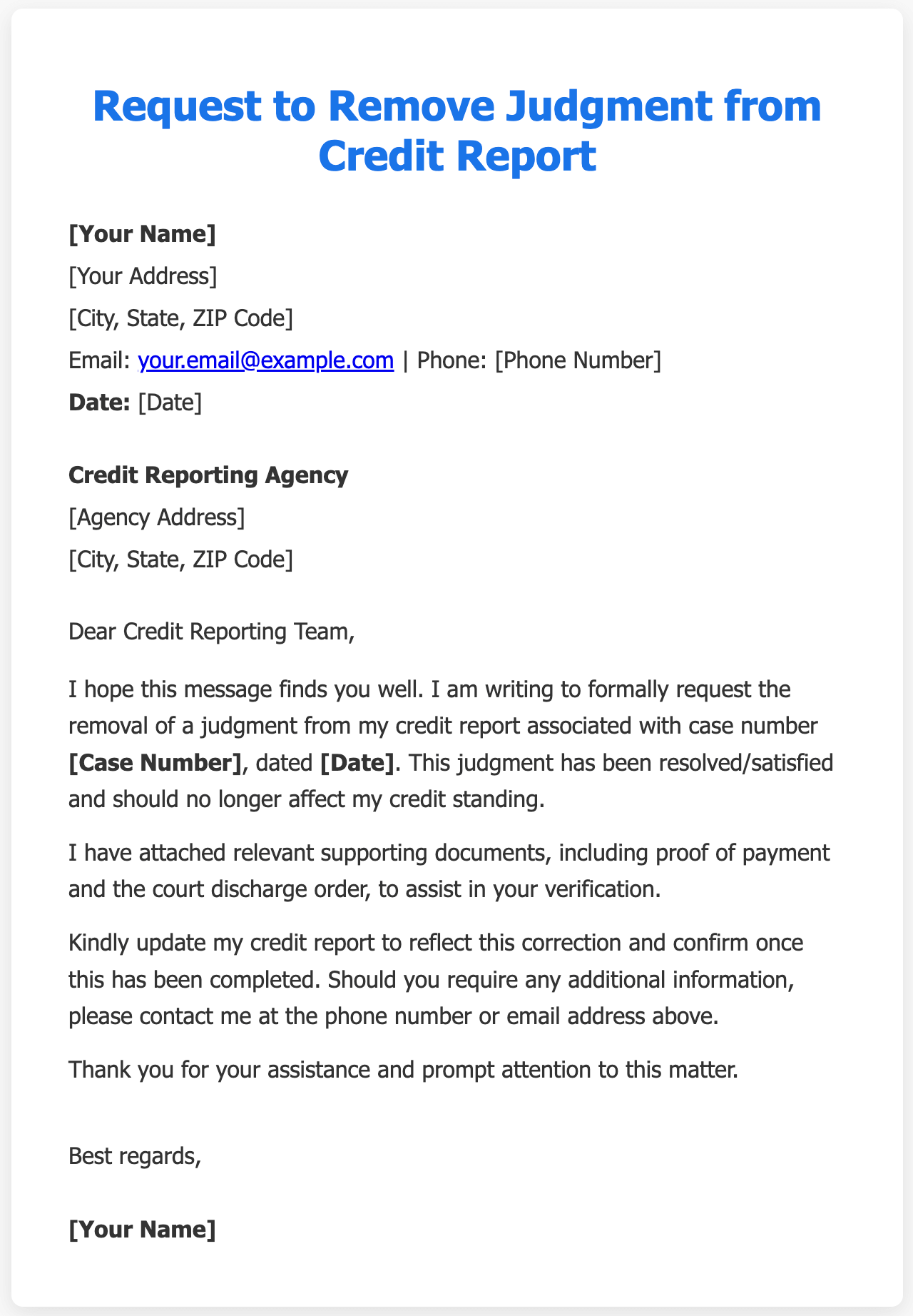

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address] | [Phone Number]

[Date]

Credit Reporting Agency

[Agency Address]

[City, State, ZIP Code]

Subject: Request to Remove Judgment from Credit Report

Dear Credit Reporting Team,

I hope this message finds you well. I am writing to formally request the removal of a judgment from my credit report, associated with case number: [Case Number], dated [Date]. This judgment has been resolved/satisfied and should no longer impact my credit standing.

Please find attached the relevant supporting documents including proof of payment and the court discharge order for your verification.

I kindly ask you to update my credit report to reflect this information and confirm once the correction has been made. If you require any additional details, please feel free to contact me at [phone number] or [email address].

Thank you for your assistance and prompt attention.

Best regards,

[Your Name]

Removing Old Judgments from Credit Letter Template

Dear Credit Reporting Agency,

I am contacting you concerning an old judgment listed on my credit report under case number [Case Number]. This judgment is outdated and should no longer appear on my credit file as it exceeds the reporting period set by credit reporting regulations.

Enclosed are documents confirming the date of the judgment and the applicable laws regarding the expiration of such items. I request you to conduct a thorough review and remove this outdated judgment from my credit report at your earliest convenience.

Thank you for your understanding and cooperation.

Kind regards,

[Your Name]

Tips for Letter Writing to Remove Judgments from Credit Reports

Be Clear and Concise

When writing your letter, state your purpose clearly at the beginning. Specify that you are requesting the removal of a judgment and provide relevant case numbers and dates. Avoid unnecessary details to keep the letter direct and professional.

Provide Supporting Documentation

Attach copies of any documents that validate your claim, such as court orders, proof of payment, or expiration notice of the judgment. This helps the credit reporting agency verify your request promptly.

Maintain a Polite and Professional Tone

Use respectful language throughout the letter. A courteous approach increases the likelihood of cooperation from the credit agency representatives reviewing your case.

Follow Up Politely

If you do not receive a response within the promised timeframe, send a polite follow-up letter or contact the agency to check the status of your request. Persistence can ensure your issue is addressed.

Know Your Rights

Familiarize yourself with your rights under credit reporting laws like the Fair Credit Reporting Act (FCRA). Citing these rights can sometimes encourage agencies to act more swiftly and accurately.

Related: