Navigating the foreclosure process requires clear and careful communication. A well-written sample letter to homeowners in foreclosure can offer a lifeline and an alternative solution.

Whether you are an investor writing a foreclosure letter to homeowners or need to understand a sample foreclosure notice from a bank, these templates provide the necessary structure and tone for this sensitive situation.

Sample Letters to Homeowners in Foreclosure

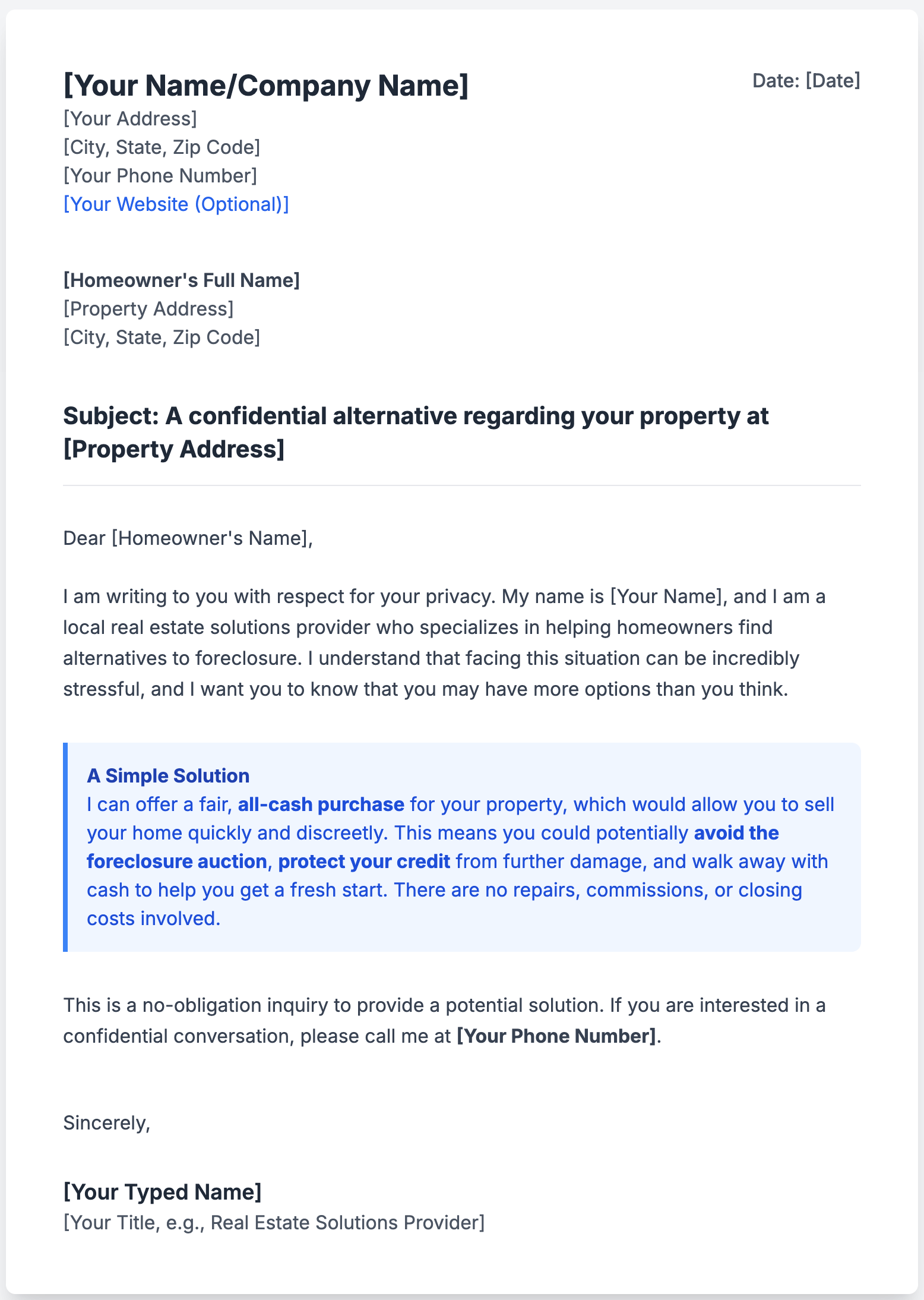

[Your Name/Company Name]

[Your Address]

[City, State, Zip Code]

[Your Phone Number]

[Your Website (Optional)]

[Date]

[Homeowner’s Full Name]

[Property Address]

[City, State, Zip Code]

Subject: A confidential alternative regarding your property at [Property Address]

Dear [Homeowner’s Name],

I am writing to you with respect for your privacy. My name is [Your Name], and I am a local real estate solutions provider who specializes in helping homeowners find alternatives to foreclosure. I understand that facing this situation can be incredibly stressful, and I want you to know that you may have more options than you think.

I can offer a fair, all-cash purchase for your property, which would allow you to sell your home quickly and discreetly. This means you could potentially avoid the foreclosure auction, protect your credit from further damage, and walk away with cash to help you get a fresh start. There are no repairs, commissions, or closing costs involved.

This is a no-obligation inquiry to provide a potential solution. If you are interested in a confidential conversation, please call me at [Your Phone Number].

Sincerely,

[Your Signature]

[Your Typed Name]

Sample Foreclosure Notice From Bank

[Lending Institution Name]

[Lender’s Address]

[City, State, Zip Code]

NOTICE OF INTENT TO ACCELERATE

Date: [Date]

Loan Number: [Loan Number]

Property Address: [Property Address]

Sent Via Certified Mail

Dear [Homeowner’s Name],

This letter is to inform you that you are in default on your mortgage loan agreement for the property referenced above. The total amount required to cure the default is $[Amount], which includes past due payments, late fees, and other charges.

You have the right to cure this default by paying the full amount due on or before [Cure Deadline Date].

If you fail to cure the default by this date, the lender will accelerate the entire loan balance and begin foreclosure proceedings. This may result in a foreclosure sale of your property.

THIS IS A COMMUNICATION FROM A DEBT COLLECTOR.

Foreclosure Letter to Homeowners

Subject: There’s Still Time to Act: An Alternative to Foreclosure Auction

Dear [Homeowner’s Name],

Public records indicate that your property at [Property Address] may be scheduled for a foreclosure auction. I know this is a difficult position to be in, but you still have the power to control the outcome.

Selling your home before the auction allows you to settle your debt with the bank and avoid the lasting impact of a foreclosure on your record. I can make you a fair cash offer and close in a matter of days, providing you with a fast and dignified exit from this situation. Please don’t wait until it’s too late. Call me today at [Your Phone Number] to discuss a solution.

Tips for Writing Foreclosure Letters

Lead with Empathy and a Respectful Tone

When contacting a homeowner in foreclosure, it is essential to remember you are reaching out to someone in a highly stressful and vulnerable situation. Your letter must reflect this understanding. Begin with a respectful and empathetic tone. Avoid aggressive, fear-based language or overly optimistic claims. Use phrases like, “I am writing with respect for your privacy” or “I understand this can be a difficult time.” This approach helps build a small amount of trust and differentiates you from predatory buyers, making it more likely the homeowner will be receptive to your message.

Offer a Clear and Simple Solution

Homeowners in distress are often overwhelmed with complex legal notices and financial jargon. Your letter should be a beacon of clarity. State your purpose directly and present your offer as a simple, easy-to-understand solution to their problem. Focus on the key benefits that address their specific pain points: stopping the auction, avoiding credit damage, selling without repairs, and receiving cash quickly. Avoid complicated terms and focus on the straightforward value you provide. A clear, tangible solution is much more appealing than a vague promise.

Maintain Professional and Ethical Boundaries

While your goal is to help, you must maintain strict professional boundaries. Your letter should make it clear that you are a real estate professional or investor, not a financial advisor, credit counselor, or lawyer. It is crucial to avoid giving any legal or financial advice. Instead, you can suggest they consult with a qualified professional. This protects you from potential liability and reinforces your credibility as an ethical operator focused solely on providing a real estate solution.

Related: