Errors on your credit report can significantly impact your financial health and borrowing ability. Whether it’s an incorrect late payment, a fraudulent account, or outdated information, you have the right to dispute these inaccuracies with credit bureaus and creditors.

Writing a formal dispute letter is the first step in cleaning up your credit report. These letters serve as official documentation of your dispute and help ensure credit bureaus investigate your claims thoroughly.

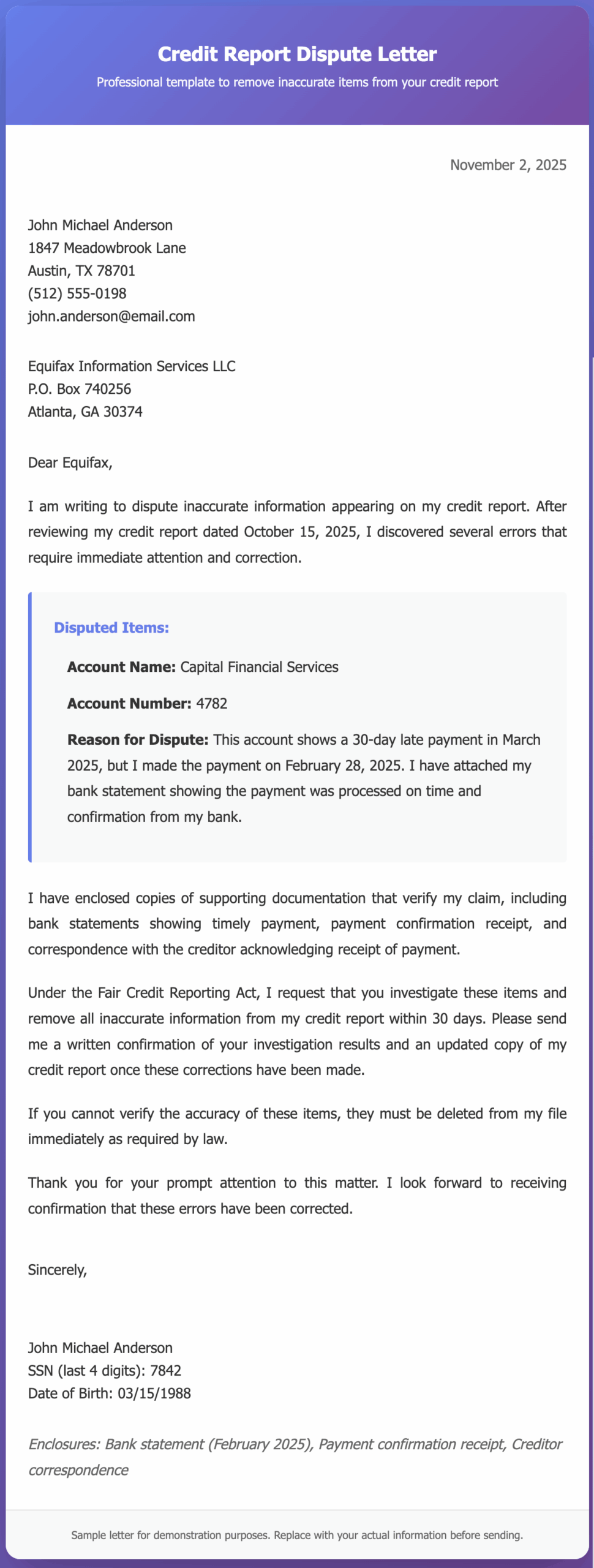

Sample Letters to Remove Items from Credit Report

Dear [Credit Bureau Name],

I am writing to dispute inaccurate information appearing on my credit report. After reviewing my credit report dated [date], I discovered several errors that require immediate attention and correction.

The following items are inaccurate and should be removed from my credit report:

Account Name: [Creditor Name] Account Number: [Last 4 digits] Reason for Dispute: [Explain why this information is incorrect – for example: “This account was paid in full on [date], but it continues to show as delinquent” or “I never opened this account and believe it may be the result of identity theft”]

I have enclosed copies of supporting documentation that verify my claim, including [list documents such as payment receipts, account statements, identity theft reports, etc.].

Under the Fair Credit Reporting Act, I request that you investigate these items and remove all inaccurate information from my credit report within 30 days. Please send me a written confirmation of your investigation results and an updated copy of my credit report once these corrections have been made.

If you cannot verify the accuracy of these items, they must be deleted from my file immediately as required by law.

Thank you for your prompt attention to this matter. I look forward to receiving confirmation that these errors have been corrected.

Sincerely,

[Your Full Name] [Your Address] [City, State ZIP Code] [Social Security Number – last 4 digits] [Date of Birth] [Phone Number]

Enclosures: [List all supporting documents]

Removing Items from Credit Report Template

I am writing to formally request the removal of inaccurate information from my credit report dated [date]. The following items contain errors that negatively affect my creditworthiness:

- [Creditor Name] – Account #[last 4 digits]: This account shows [describe error – late payments/wrong balance/account I didn’t open]. The correct information is [state what should appear].

- [Creditor Name] – Account #[last 4 digits]: This entry is [outdated/belongs to someone else/already resolved] and should be completely removed.

I have attached documentation supporting my dispute, including [payment confirmations/police reports/correspondence with creditor]. Please investigate these items immediately and remove all unverifiable or inaccurate information within the 30-day period required by federal law.

Send me written confirmation of the investigation results and an updated credit report reflecting these corrections.

[Your Name]

[Contact Information]

[SSN – last 4 digits]

Letter to Correct Credit Report

I recently obtained my credit report and found several inaccuracies that require correction. These errors are damaging my credit score and ability to obtain credit.

The incorrect information includes:

[Creditor Name], Account #[xxxx]: Shows balance of $[amount], but actual balance is $[amount] as of [date]. Enclosed is a recent statement proving the correct balance.

[Creditor Name], Account #[xxxx]: Reports [number] late payments in [months/year], but all payments were made on time. Attached are bank statements showing timely payments.

[Creditor Name], Account #[xxxx]: This account appears twice on my report with different account numbers, creating a duplicate entry.

These errors violate the Fair Credit Reporting Act’s requirement for accurate reporting. I request immediate correction of these items and removal of any information you cannot verify as completely accurate. Please provide written confirmation once corrections are completed and send an updated credit report.

[Your Name]

[Contact Information]

Letter to Credit Bureau Disputing

I am formally disputing inaccurate information on my credit report that I obtained on [date]. These errors are affecting my credit score and must be investigated.

Disputed items:

[Company Name] – Account ending in [xxxx]: This account is not mine. I have never had any business relationship with this company. This may be a case of identity theft or mixed credit files.

[Company Name] – Account ending in [xxxx]: This account was discharged in bankruptcy on [date] under case number [xxxx], but continues to show an outstanding balance.

[Company Name] – Account ending in [xxxx]: This collection account is beyond the seven-year reporting period and should be removed.

Federal law requires you to investigate disputed items and delete any information that cannot be verified. I expect this investigation to be completed within 30 days. Please send written notice of the investigation results and provide a corrected credit report.

[Your Name]

[Contact Information]

[Date]

Dispute Letters to Creditors Template

I am writing directly to your company to dispute inaccurate information you are reporting to credit bureaus about my account.

Account Number: [full account number] Issue: [Describe the problem – incorrect payment history/wrong balance/account status error]

According to my records, [explain the accurate information]. I have enclosed supporting documentation including [receipts/statements/correspondence] that proves the information you are reporting is incorrect.

Under the Fair Credit Reporting Act and Fair Credit Billing Act, you are required to investigate disputes and report accurate information to credit bureaus. I request that you:

- Conduct an immediate investigation of this dispute

- Correct the inaccurate information in your records

- Send updated accurate information to all credit bureaus where you reported this account

- Provide me written confirmation of the corrections made

Please complete this investigation within 30 days and send me documentation confirming the corrections have been reported to Equifax, Experian, and TransUnion.

[Your Name]

[Address]

[Phone Number]

[Email Address]

Writing Effective Credit Dispute Letters

Be Specific and Clear About Each Error

Identify each inaccurate item with complete details including the creditor’s name, account number, and the specific error you’re disputing. Vague complaints make it difficult for credit bureaus to investigate your claim. State exactly what information is wrong and what the correct information should be. For example, instead of saying “my payment history is wrong,” specify “the report shows a 30-day late payment in March 2024, but I made the payment on February 28, 2024.”

Include Strong Supporting Documentation

Always attach copies of documents that prove your claim. These might include bank statements showing timely payments, settlement agreements, paid-in-full letters, identity theft reports, or correspondence with creditors. Never send original documents as they won’t be returned. Organize your evidence clearly and reference each document in your letter. Strong documentation significantly increases the likelihood that your dispute will be resolved in your favor.

Use Certified Mail for Important Disputes

Send your dispute letters via certified mail with return receipt requested. This creates a legal record showing when the credit bureau received your letter, which starts the 30-day investigation clock required by law. Keep copies of everything you send. This documentation becomes crucial if you need to escalate your dispute or take legal action. Regular mail provides no proof of delivery or receipt.

Follow Up Consistently

Credit bureaus have 30 days to investigate disputes, but they may need reminders. If you don’t receive a response within this timeframe, send a follow-up letter referencing your original dispute and the date sent. Keep detailed records of all communications including dates, confirmation numbers, and representative names. Persistent follow-up demonstrates your seriousness and keeps your dispute active in their system.

Know Your Rights Under Federal Law

The Fair Credit Reporting Act gives you the right to dispute inaccurate information and requires credit bureaus to investigate. If items cannot be verified, they must be removed. You’re entitled to free credit reports after disputes and can add explanatory statements to your file. Understanding these rights helps you write more authoritative letters and recognize when bureaus aren’t complying with legal obligations.

Related: