When the IRS requests clarification, a clear written explanation or a concise response letter can make the process smoother. These sample letters—covering a written explanation, a response letter, and a cover letter example—are structured so you can copy, adapt, and submit them with confidence.

Each example uses professional language, includes the essential details the IRS expects, and highlights how to present dates, amounts, and supporting documentation to speed review.

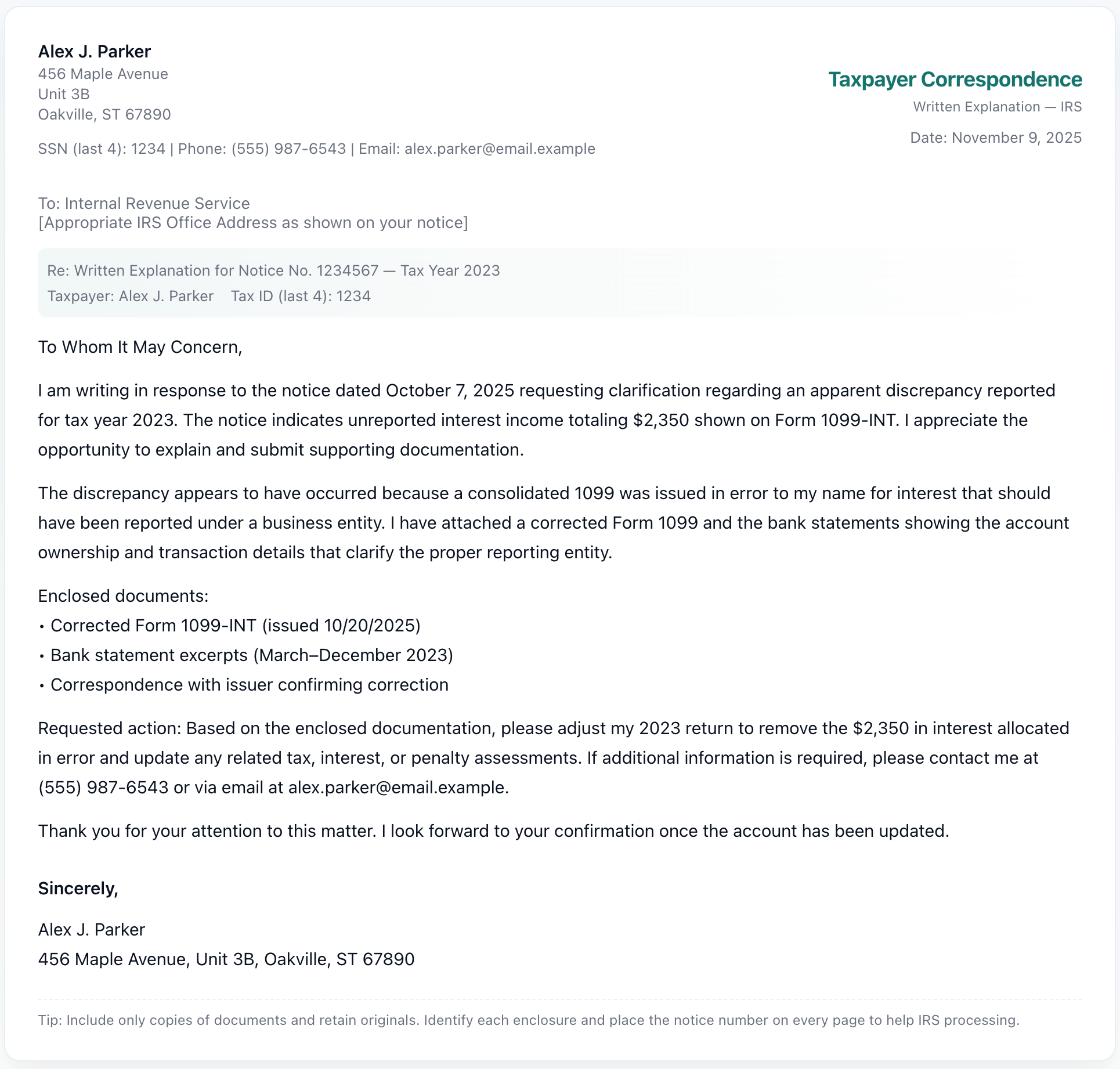

Written Explanation Sample Letter To IRS

[Your Name]

[Your Address]

[City, State ZIP]

[SSN or Tax ID (last 4 digits only): XXXX]

[Phone Number]

[Email Address]

Date: November 9, 2025

Internal Revenue Service

[Appropriate IRS Office Address from Your Notice]

Re: Written Explanation for Notice Number [Notice Number] — Tax Year [YYYY]

Taxpayer: [Your Full Name]

Tax ID: [XXX-XX-1234]

Dear Sir or Madam,

I am writing in response to the Notice dated [notice date] requesting clarification regarding [brief description of issue — e.g., unreported income, deduction disallowance, or math error] for tax year [YYYY]. I appreciate the opportunity to provide a written explanation and to submit supporting documents.

Issue: On the Form [Form number] the discrepancy appears related to [explain clearly — e.g., “unreported interest of $2,350 reported on Form 1099-INT” or “business expense deductions questioned”]. The reason for the discrepancy is [concise factual explanation — e.g., “the amount was included on a consolidated 1099 issued to a different entity in error” or “a bookkeeping timing difference occurred between calendar and fiscal reporting”].

Supporting Documents: Enclosed please find copies of the following items that substantiate my position:

• [Document 1 — e.g., corrected Form 1099, bank statement]

• [Document 2 — e.g., invoices, receipts, ledger excerpt]

• [Document 3 — if applicable]

Requested Action: Based on the enclosed documentation, I respectfully request that the IRS accept the corrected amount of [$X,XXX] and revise the assessed tax/penalty accordingly. If additional information is needed, I am available at [phone number] or [email] and will respond promptly.

Thank you for your attention to this matter.

Sincerely,

[Your Signature (if mailing)]

[Your Printed Name]

Sample Response Letter To IRS

[Your Name]

[Your Address]

[City, State ZIP]

[Tax ID (last 4 digits): XXXX]

Date: [MM/DD/YYYY]

Internal Revenue Service

[Address from Notice]

Re: Response to Notice No. [Notice Number]; Tax Year [YYYY]

To Whom It May Concern,

I received Notice No. [Notice Number] indicating a proposed adjustment for tax year [YYYY]. After reviewing my records, the adjustment appears to stem from [short factual cause — e.g., “duplicate reporting on a 1099” or “misapplied payment recorded on the IRS account”]. Enclosed are copies of [list documents] demonstrating the correct treatment.

Please apply the enclosed documents to my account and confirm any resulting change in the balance due or refund. I request written confirmation once the account is updated. Thank you for your assistance.

Respectfully,

[Your Name]

[Phone / Email]

Cover Letter Examples For IRS

[Your Name]

[Your Address]

[City, State ZIP]

[Tax ID (last 4 digits): XXXX]

Date: [MM/DD/YYYY]

Internal Revenue Service

[Address on Notice or Correspondence]

Re: Enclosures for Notice No. [Notice Number] — Tax Year [YYYY]

Please find enclosed the following documents submitted in response to your notice dated [notice date]:

- Written explanation addressing the adjustment.

- Copies of supporting documents: [list documents].

- Completed forms as requested: [list forms].

I have labeled each enclosure and included my taxpayer identification on every page for ease of processing. Please contact me at [phone] if you require any additional documentation. Thank you for your prompt attention.

Sincerely,

[Your Name]

Tips For Writing Letters To The IRS

Be Clear And Concise

Start with a brief header that repeats the IRS notice number, the tax year in question, and the taxpayer’s identification (use only the last four digits of your SSN/Tax ID). In the first paragraph, state why you are writing—whether to explain an item, correct an error, or submit requested documents. Keep sentences short and factual; avoid lengthy narratives that may obscure the central point.

Organize Supporting Documents

Create a clear list of enclosures and label each attachment (e.g., Exhibit A: Bank Statement, Exhibit B: Corrected 1099). Refer to these labels in the body of your letter when explaining a specific point. If you are submitting multiple pages, staple or bind them together and include a cover page that lists the documents by exhibit number.

Use Professional Tone And Exact Dates/Amounts

Record the exact dates, amounts, form numbers, and notice identifiers. Instead of saying “last year” or “a few months ago,” write exact dates and amounts (e.g., “$2,350 received on 03/15/2024, reported on Form 1099-INT”). This precision helps IRS reviewers match your explanation to their records and reduces back-and-forth.

Provide A Single Requested Outcome

Tell the IRS what you want them to do—accept the corrected amount, remove a penalty, or adjust the account balance—and base that request on the evidence you supply. If you expect a refund, state the method of refund delivery you prefer or confirm the bank account information only when it is requested through secure channels.

Keep Copies And Track Delivery

Always keep a complete copy of every letter and enclosure you send. Use certified mail with return receipt or another trackable method if the matter is time-sensitive or likely to affect penalties. Note the date you mailed or electronically submitted the response, and retain postal or tracking records.

Follow-Up And Be Responsive

If the IRS requests additional information, respond quickly, using the same formatting and labeling approach. If you receive no acknowledgment within a reasonable period (typically 30–60 days for mailed submissions), call the phone number on your notice and reference your original correspondence date and tracking number.

Related: